Crypto Market Sentiment Analysis

Crypto Market Summary Analysis

The crypto market shows mixed signals with a balance of optimism and caution. Bitcoin faces declining momentum with several reports highlighting struggles to maintain upward trends, while Ethereum and XRP exhibit resilience amid broader market challenges. Positive developments include institutional interest in Ripple via Coinbase integration and growing XRP Ledger utility. However, geopolitical tensions and oil price surges add pressure, impacting overall sentiment. Bitcoin ETF inflows and strategic investments signal long-term confidence, yet short-term volatility remains a concern. Regulatory moves, like South Korea's stablecoin restrictions, introduce uncertainty. Overall, the market oscillates between recovery potential and downside risks, reflecting a neutral outlook.

Our market sentiment analysis processes a wide array of market data to generate comprehensive crypto sentiment scores. The sentiment score reflects current market conditions, ranging from negative to positive, summarizing overall sentiment. We also provide individual sentiment analysis, offering coin specific sentiment based on the latest market data. We aggregate coin mentions and provide an individual coin sentiment performance score. See FAQs for details.

Individual Cryptocurrency Sentiment Analysis

Historical Market Sentiment

Top Mentioned Coins Last Month

🥇 Bitcoin (BTC) Neutral (51)

🥈 Ethereum (ETH) Neutral (52)

🥉 XRP (XRP) Positive (61)

High and Low Sentiment Current Year

🚀 January 6, 2026 Positive (78)

📉 February 5, 2026 Negative (25)

Latest Bitcoin & Crypto News

Epstein Files Reveal How Banks Shape a Hidden Financial World

Central banks manufacture scarcity to keep the world grinding. And now, fresh evidence from the Epst...

How Central Banks Create Scarcity and Why Bitcoin Offers a Way Out

We are conditioned to exist within a state of perpetual exhaustion, sacrificed on the altar of the &...

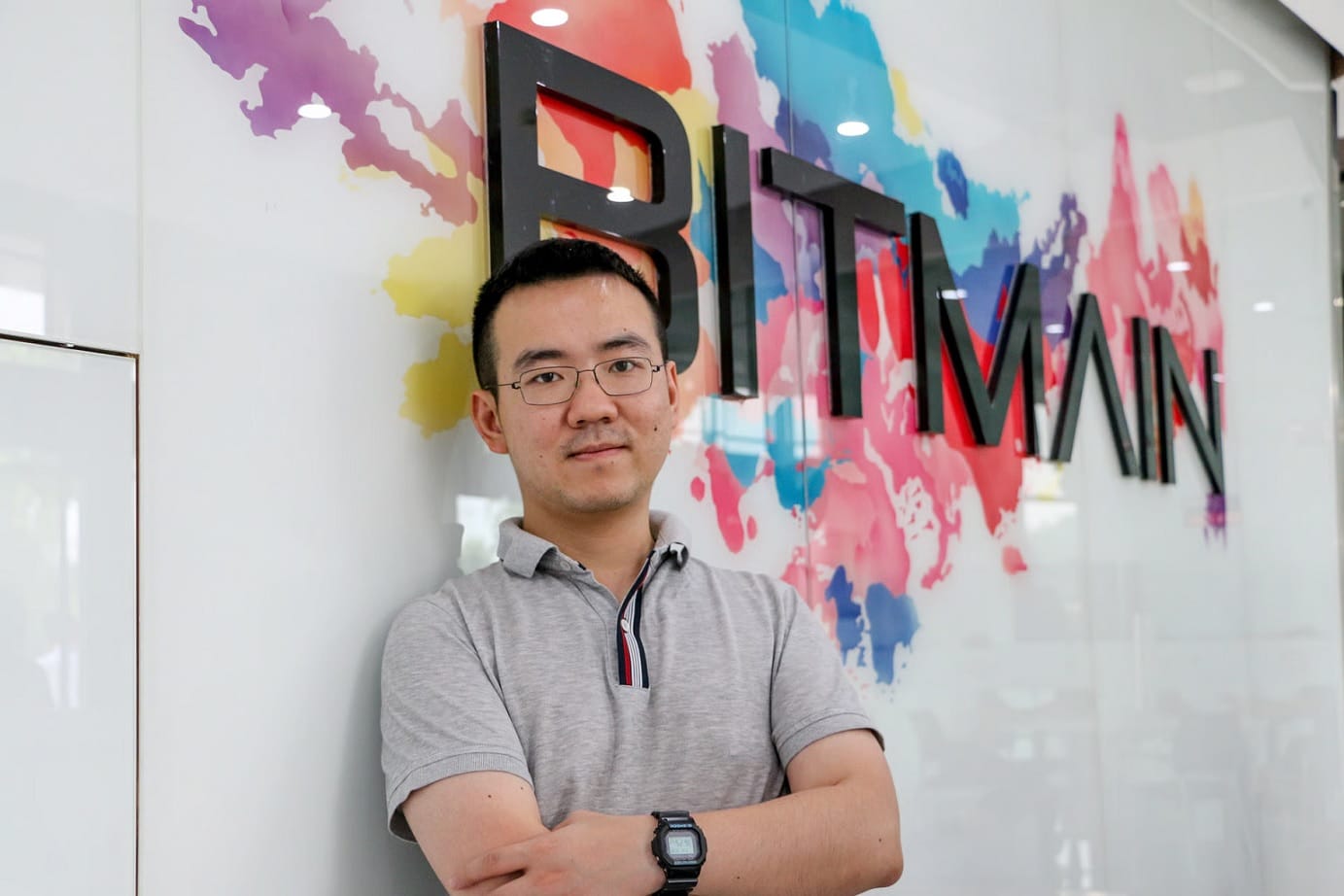

Epstein’s 2018 Bitmain Investment Deal That Came Down to the Wire

Newly released documents from the Jeffrey Epstein files reveal that in August 2018, at one of the Bi...

Argentina's Javier Milei Secret Blockchain Deal Surfaces as LIBRA Investigation Intensifies

Argentinian prosecutors have uncovered a confidential blockchain advisory agreement linking Presiden...

Whistleblower Publishes Internal Pump.fun Chats Alleging Security Vulnerabilities

A former developer for Pump.fun has released a large archive of internal Telegram communications, st...

Joi Ito Leaves Japanese Government Tech Project After Epstein Files Released

Joi Ito is stepping away from a major government technology initiative in Japan after new attention ...

Bitcoin Mining Pressures Mount as Marathon Signals Possible Reserve Sales

Marathon Digital has formally opened the door to selling its Bitcoin reserves, marking a significant...

Puppet Masters: What the Epstein Files Reveal About Bitcoin

Looking back from the vantage point of February 2026, the release of the Jeffrey Epstein emails rema...